Understanding the Mortgage Process for Lenders

The mortgage process is a critical journey for both borrowers and lenders, involving multiple steps and specialized roles. Understanding this process is essential for lenders aiming to streamline their operations and deliver an excellent customer experience. This guide provides an exhaustive look into the mortgage process for lenders, outlining the key stages, roles, terminology, and best practices.

What is the Mortgage Process?

The mortgage process generally refers to the procedure by which lenders assess the financial qualifications of potential borrowers to grant them loans for purchasing real estate. It encompasses various stages, including pre-approval, application, underwriting, and closing. Each phase plays a distinctive role in determining whether the borrower qualifies for a mortgage, how much they can borrow, and the interest rates applicable to their loan.

Key Roles in the Mortgage Process

There are several key players in the mortgage process, each with specific responsibilities:

- Loan Officers: These professionals interact directly with borrowers, guiding them through the pre-approval and application processes.

- Underwriters: They analyze the borrower’s financial information and the property details, assessing risk to decide if the mortgage should be approved.

- Loan Processors: These individuals handle documentation and ensure that everything is in order before it goes to underwriting.

- Mortgage Brokers: Brokers serve as intermediaries who help borrowers find the best mortgage options available based on their unique needs.

- Escrow Officers: Their role comes into play during closing, handling the transfer of funds and documents once all contingencies are met.

Common Terminology Explained

Familiarizing oneself with mortgage jargon is vital for lenders. Here are some crucial terms:

- APR (Annual Percentage Rate): The total cost of borrowing expressed as a yearly interest rate, including both the interest rate and any additional fees.

- Principal: The amount of money borrowed from the lender.

- Down Payment: The initial cash amount paid by the borrower, which is typically a percentage of the home’s purchase price.

- Amortization: The process of spreading out a loan into a series of fixed payments over time.

- Escrow: A neutral third party that holds funds or documents until specific conditions are fulfilled in a transaction.

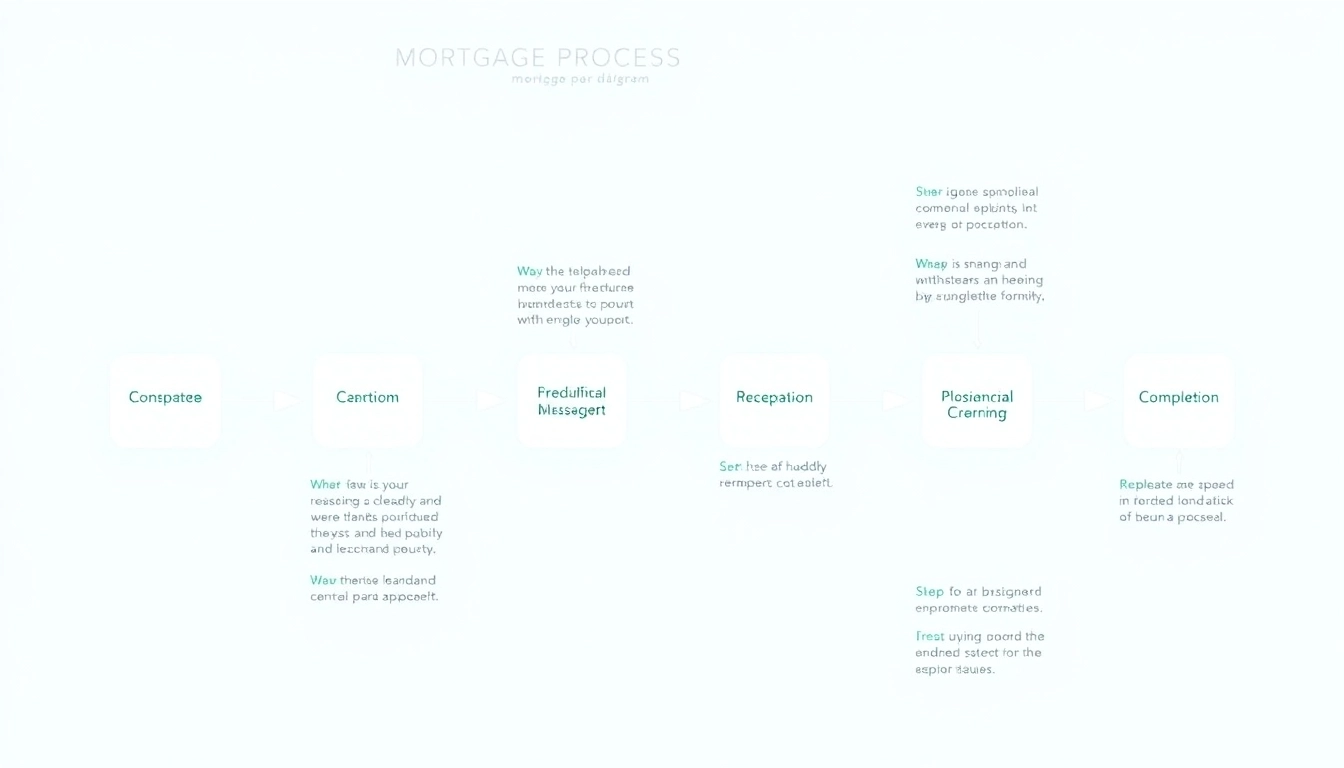

Steps in the Mortgage Process for Lenders

Pre-Approval: What Lenders Need to Know

The pre-approval stage is crucial for lenders and involves evaluating potential borrowers’ creditworthiness. An accurate assessment helps lenders understand the risk involved and enables borrowers to know how much they can afford. This typically includes:

- Checking the borrower’s credit score and history.

- Assessing income and employment verification.

- Calculating debt-to-income ratios to determine affordability.

Gathering Documentation

Once pre-approved, the next step for lenders is documentation. Borrowers will need to provide essential documents, which include:

- Tax returns for the previous two years

- Recent pay stubs and W-2 forms

- Bank statements to verify assets

- A government-issued ID

- Additional documentation depending on the loan type (e.g., business income, alimony information, etc.)

Lenders must ensure that all documentation is complete, accurate, and submitted in a timely manner to avoid delays in the processing phase.

Submitting the Mortgage Application

The formal mortgage application is the document that lenders use to initiate the loan process. Key elements of the application include:

- The type of loan requested

- The loan amount

- The borrower’s financial details

- The property information

- Intentions regarding the occupancy of the property

Understanding the borrower’s needs and preferences allows lenders to recommend the most suitable mortgage options.

Timeline of the Mortgage Process

How Long Does Each Step Take?

The timeline of the mortgage process can vary significantly based on various factors, including the lender, type of loan, and market conditions. Generally, the stages can be broken down as follows:

- Pre-Approval: 1 to 3 days, depending on the lender’s response time.

- Application Submission: Approximately 3 to 5 days.

- Loan Processing: 5 to 10 days.

- Underwriting: 3 to 5 days on initial review, potentially longer if additional information is needed.

- Closing: 1 day for final paperwork; however, scheduling can result in an overall wait of 2 to 4 weeks to close.

Understanding Closing Times

Closing times can vary based on the lender’s policies and the complexity of the loan. Factors influencing this time include:

- The efficiency of processing each step

- Response times for additional documentation from borrowers

- State regulations and requirements

- Any contingencies that need to be resolved (e.g., inspection results)

Factors That Can Delay the Process

Various elements can cause delays in the mortgage process. Some of the most common are:

- Credit Issues: If a borrower has existing debt or poor credit history, obtaining additional documentation or explanations can delay approval.

- Appraisal Delays: Scheduling and completing property appraisals can take longer in busy markets.

- Incomplete Documentation: Missing or inaccurate documents can lead to repeated requests and extended timelines.

- Changes in Borrower Financial Status: If a borrower experiences a job change, change in income, or a large purchase during the underwriting phase, this can prompt reevaluation.

Common Challenges in the Mortgage Process

Dealing with Credit Issues

Credit issues are a significant hurdle for many borrowers. Lenders must adopt strategies to handle these situations effectively, such as:

- Providing education about credit scores and how to improve them.

- Offering products for borrowers with less-than-perfect credit, potentially highlighting benefits of FHA or VA loans.

- Implementing a pre-qualification process to identify potential issues early.

Managing Borrower Expectations

Transparent communication is key in managing borrower expectations throughout the mortgage process. Steps include:

- Setting clear timelines for each stage of the process.

- Regular updates throughout the process, especially when delays arise.

- Providing straightforward explanations for any complex terms or requirements.

Navigating Regulatory Compliance

The mortgage industry is heavily regulated, and keeping up with changes can be challenging. Strategies for lenders include:

- Regular training for staff on regulatory changes and compliance practices.

- Investing in compliance management software to track and manage documentation requirements safely.

- Engaging with legal counsel specializing in mortgage regulations to ensure adherence.

Best Practices for Lenders

Effective Communication with Borrowers

Effective communication is crucial for establishing trust with borrowers. Lenders should aim to:

- Clearly explain each step of the process and what is expected from the borrower.

- Utilize multiple communication channels (phone, email, text) to engage with borrowers based on their preferences.

- Encourage questions and provide thorough answers to ensure borrower confidence.

Utilizing Technology for Efficiency

The integration of technology can greatly enhance the mortgage process. Lenders should consider:

- Implementing online application systems that streamline documentation submission.

- Leveraging automated communication tools to keep borrowers informed on their application status.

- Utilizing data analytics for assessments and predictive modeling, enabling quicker decision-making.

Continuous Education and Training

Ongoing education and training are vital for lenders to stay competitive. Best practices include:

- Offering regular workshops and training sessions surrounding new tools and regulations.

- Encouraging staff participation in industry seminars and networking events.

- Creating a culture of knowledge-sharing within the organization to encourage best practices.